Bitcoin in Practice: Despite the ideal concept of Bitcoin decentralization, the reality is that it may not be as decentralized as some proponents may claim. In practice, there are various metrics that indicate Bitcoin’s performance falls short of expectations. While the network operates on a peer-to-peer basis and does not require a central authority to facilitate transactions, certain aspects of its structure have raised concerns about its level of decentralization.

Contents

- 1 Examining the Reality of Bitcoin Decentralization in Practice

- 1.1 Uncovering the Realities of Bitcoin’s Decentralization and Performance: 5 Key Concerns

- 1.2 Bitcoin in practice: Bookkeeping Nodes

- 1.3 Bitcoin in practice and Mining

- 1.4 Bitcoin in practice: Mining Hardware

- 1.5 Bitcoin in practice: BTC ownership

- 1.6 Upgrades to the Bitcoin Protocol

- 1.7 Transaction Fees

- 1.8 Conclusion

Examining the Reality of Bitcoin Decentralization in Practice

For instance, mining pools have consolidated significant portions of the network’s hash rate, allowing a few entities to have considerable control over the network. Additionally, the distribution of Bitcoin ownership is highly concentrated, with a relatively small group of individuals and entities holding the majority of the coins. These factors raise questions about the true level of decentralization of the network and its ability to fulfill the vision of a fully decentralized digital currency.

One of the issues that affects Bitcoin’s decentralization is the role of bookkeeping nodes. These nodes, also known as full nodes, play an essential role in the network’s operation by verifying transactions and blocks and keeping a complete copy of the blockchain. However, running a full node requires significant computational resources and storage capacity, which can be a barrier to entry for some users.

Furthermore, the number of bookkeeping nodes has been declining over time, which has raised concerns about the centralization of the network. In recent years, there has been a trend towards using lightweight clients that do not require users to run a full node, which may further contribute to centralization.

In summary, while Bitcoin’s decentralized nature is one of its core strengths, the reality of its performance may not live up to its idealistic vision. The concentration of mining power and ownership, as well as the decline in bookkeeping nodes, are just a few of the factors that raise questions about the true level of decentralization of the network. As the technology continues to evolve, it will be interesting to see how these issues are addressed and whether Bitcoin can truly fulfill its potential as a decentralized digital currency.

Uncovering the Realities of Bitcoin’s Decentralization and Performance: 5 Key Concerns

Here are five realities of Bitcoin in practice that relate to concerns about its decentralization and performance:

-

Concentration of Mining Power: The mining process of Bitcoin has become increasingly centralized, with a few mining pools controlling a significant portion of the network’s hash rate.

-

Unequal Distribution of Ownership: A relatively small number of individuals and entities hold the majority of Bitcoin, leading to concerns about centralization of ownership.

-

Limited Scalability: Bitcoin’s network has struggled to keep up with growing demand, resulting in slower transaction times and higher fees.

-

Energy Consumption: The mining process requires a significant amount of energy, leading to concerns about the environmental impact of Bitcoin.

-

Governance Issues: As a decentralized network, Bitcoin lacks a clear governance structure, making it difficult to make decisions and implement changes that benefit the entire network

While Bitcoin operates on a peer-to-peer basis and does not require a central authority to facilitate transactions, the reality is that it may not be as decentralized as some proponents claim. Bookkeeping nodes play a crucial role in maintaining the integrity of the blockchain, and the concentration of these nodes in the hands of a few entities raises concerns about the level of centralization in the network.

Moreover, mining pools have consolidated significant portions of the network’s hash rate, allowing a few entities to have considerable control over the network. Additionally, the distribution of Bitcoin ownership is highly concentrated, with a relatively small group of individuals and entities holding the majority of the coins. These factors raise questions about the true level of decentralization of the network and its ability to fulfill the vision of a fully decentralized digital currency.

Bitcoin in practice: Bookkeeping Nodes

While there are around 10,000 nodes who perform bookkeeping tasks and who relay transactions and blocks, they are mostly running the same software written, and therefore controlled, by a very small number of people. They are known as the ‘Bitcoin Core’ developers and the software is known as ‘Bitcoin Core’.

The various versions, or implementations, that are not Bitcoin Core all have slightly different rules but are not different enough to create incompatibilities. Some, for example, may have additional flags to signal that the bookkeepers would be prepared to adopt a rule change if enough participants also signal the same intention.

Bitcoin in practice and Mining

Although anyone can mine, the process has become so intensive that new hardware and chips are created which are designed to be exceedingly efficient at performing the SHA-256 hashing. ASICs (Application Specific Integrated Chips) became the norm for mining in 2014 and outcompete all other forms of hardware in terms of energy efficiency for Bitcoin mining. Dave Hudson explores the effects of ASICs in his excellent blog Hashing It105.

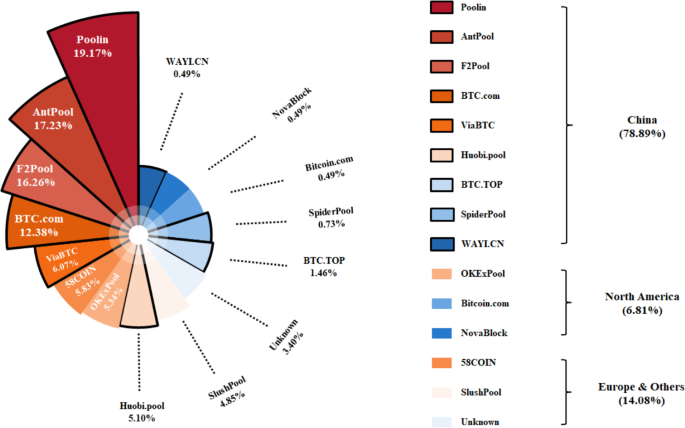

In the popular media, the computational power of these specially designed chips is often compared to the computational power of supercomputers, but ACICs cannot operate as general-purpose computers, so comparisons with supercomputers are meaningless. Only a few entities can mine profitably, usually using special purpose ‘mining farms’ clustered in areas of cheap electricity. The chart below shows miners and what proportion of blocks they have recently mined. The proportion of blocks they have mined is roughly equivalent to their hashing power as a proportion of the total hashing power of the network.

Single mining entities

Some of these are single mining entities. Others are syndicates that anyone can join, contribute hash power, and receive rewards in proportion to their contributions. At an estimate, around 80% of the hash power is controlled by Chinese entities. BTC.com, Antpool, BTC.TOP, F2Pool, viaBTC are all Chinese groups107, and a company called Bitmain owns both BTC.com and Antpool. Hence, if only the top three mining pools collaborate, they can reorganise blocks and arrange double spends, and no one would be able to stop them as they represent more than 50% of the total hashing power. So this is not a well-decentralised system.

It is often argued that miners wouldn’t do this because it would cause a loss of confidence in Bitcoin and thus cause the price to fall, and their stock of bitcoins would be worth less. However, an enterprising group of miners who carried this out could build a temporary large short trading position just before executing a double spend and profit on the fall in price of BTC.

Bitcoin in practice: Mining Hardware

As discussed, miners use special purpose chips called ASICS that are specifically designed and built to be efficient at SHA256 hashing. Commercial chip manufacturers have been slow to design chips that are specifically built to be efficient at SHA256 hashing, so demand has created an alternative specialised industry for supplying Bitcoin ASICs. The main provider of this is Bitmain, the same Chinese company who controls the top two mining pools. It has been estimated that Bitmain produces hardware that mines 70-80% of the total blocks in Bitcoin. Bitcoin hardware manufacturing is not well decentralised.

Bitcoin in practice: BTC ownership

The ownership of BTC too shows a concentration in a small number of hands:

According to this analysis, almost 90% of value is owned by fewer than 0.7% of the addresses. Of course, we have to treat this kind of analysis with some caution. Some large wallets are controlled by exchanges who take custody of coins on behalf of a large number of users. So the table might be overstating the centralisation of Bitcoin ownership. Against that, some people might spread out their bitcoins across a large number of wallets in order to not attract attention.

This is very easy to do. So the table might be understating the centralisation of Bitcoin ownership. However, it remains highly likely that, just as in the non-crypto world, very few people probably own the vast proportion of the value. Now, there’s a surprise.

Upgrades to the Bitcoin Protocol

Upgrades to the Bitcoin network and protocols are also fairly centralised. Changes are suggested in ‘Bitcoin Improvement Proposals’ (BIPs). These are documents that anyone may write but, but they all end up on a single website: https://github.com/bitcoin/bips. If it gets written into the Bitcoin Core software on Github, https://github.com/bitcoin/Bitcoin, it forms part of an upgrade, the next version of ‘Bitcoin Core’ which is the

most commonly used software, or ‘reference implementation,’ of the protocol. As we have seen, this is run by the vast majority of participants.

Transaction Fees

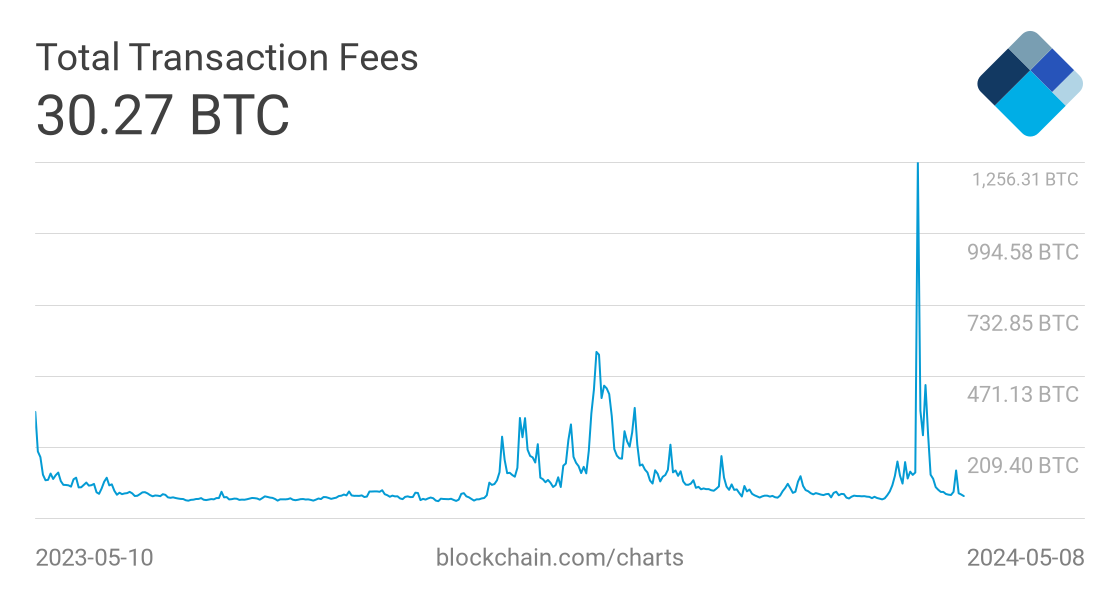

In theory, the transaction fees collected per block is meant to compensate for the decrease in block reward as the network gets more popular over time. The reality is that this doesn’t seem to be working out.

The chart shows that except for a brief spike at the end of 2017, the total transaction fees have stayed stubbornly low at approximately 200 BTC per week. Compare this with the new 12,600 BTC generated from coinbase rewards per week (12.5 BTC per block x 6 blocks/hour x 24 hours/day x 7 days/week = 12,600 BTC, a figure which reduced by half in 2016, and is estimated to half again in 2020). Without significant increase in transaction fees to compensate, clearly the economics of Bitcoin mining will change.

Conclusion

While Bitcoin has been heralded as the future of money and the epitome of decentralization, the reality is more nuanced. The concept of Bitcoin is undoubtedly revolutionary, but its practical implementation has raised concerns about the level of decentralization and performance. Bitcoin’s predecessors, such as b-money and hashcash, have laid the groundwork for the creation of Bitcoin, but the current network structure has led to the consolidation of mining power and the concentration of ownership, which challenges the notion of a fully decentralized currency.

Nonetheless, the fact remains that Bitcoin has captured the attention of millions and continues to be one of the most exciting developments in the financial world. As the technology evolves, it will be interesting to see how the issues of decentralization and performance are addressed to fulfill the original vision of Bitcoin.